GrowthPal raises $2.6M to turn M&A from relationship-driven guesswork into an AI-led growth engine

As companies increasingly rely on acquisitions to drive growth, deal sourcing remains slow, opaque, and dominated by in-market opportunities. GrowthPal is using AI to help teams surface off-market targets and move from strategy to action in days, not months.

Singapore, Jan. 14, 2026 (GLOBE NEWSWIRE) -- For most companies, inorganic growth depends on timing, context, and access. Yet M&A deal origination from mid-market and early stage companies, has changed little in decades, still driven by banker networks, static databases, and fragmented research workflows. Buyers often see only what is already on the market, while high-quality, off-market opportunities remain hidden. GrowthPal, co-founded by Maneesh Bhandari, Shalu Mitruka and Amaresh Shirsat, was built to change this dynamic. Today, the company announced a $2.6 million funding round to accelerate its AI-powered M&A copilot for deal sourcing and execution.

Growthpal founders: (L to R) Maneesh Bhandari, Shalu Mitruka and Amaresh Shirsat.

The round was led by Ideaspring Capital with participation from prominent angel investors globally. The new capital will support product development and expand GrowthPal’s presence across the US and international markets as demand grows for faster, more programmatic approaches to inorganic growth.

The announcement comes as M&A teams face increasing pressure to do more with less. Corporate development teams are leaner, timelines are compressed, and competition for quality assets is intensifying. While platforms like PitchBook, D&B, Datasite, and Tracxn have made company data more accessible, they largely stop at aggregation. GrowthPal addresses a different need by applying AI-driven reasoning to help teams identify which companies actually matter, based on strategic intent, sector context, and readiness to transact.

“M&A sourcing is where most time and effort is wasted, especially for smaller and mid-market deals,” said Maneesh Bhandari, co-founder and CEO of GrowthPal. “Teams spend weeks researching, filtering, and chasing opportunities that never go anywhere. We built GrowthPal to help buyers focus only on high-intent, high-fit targets and move from mandate to meaningful conversations far faster.”

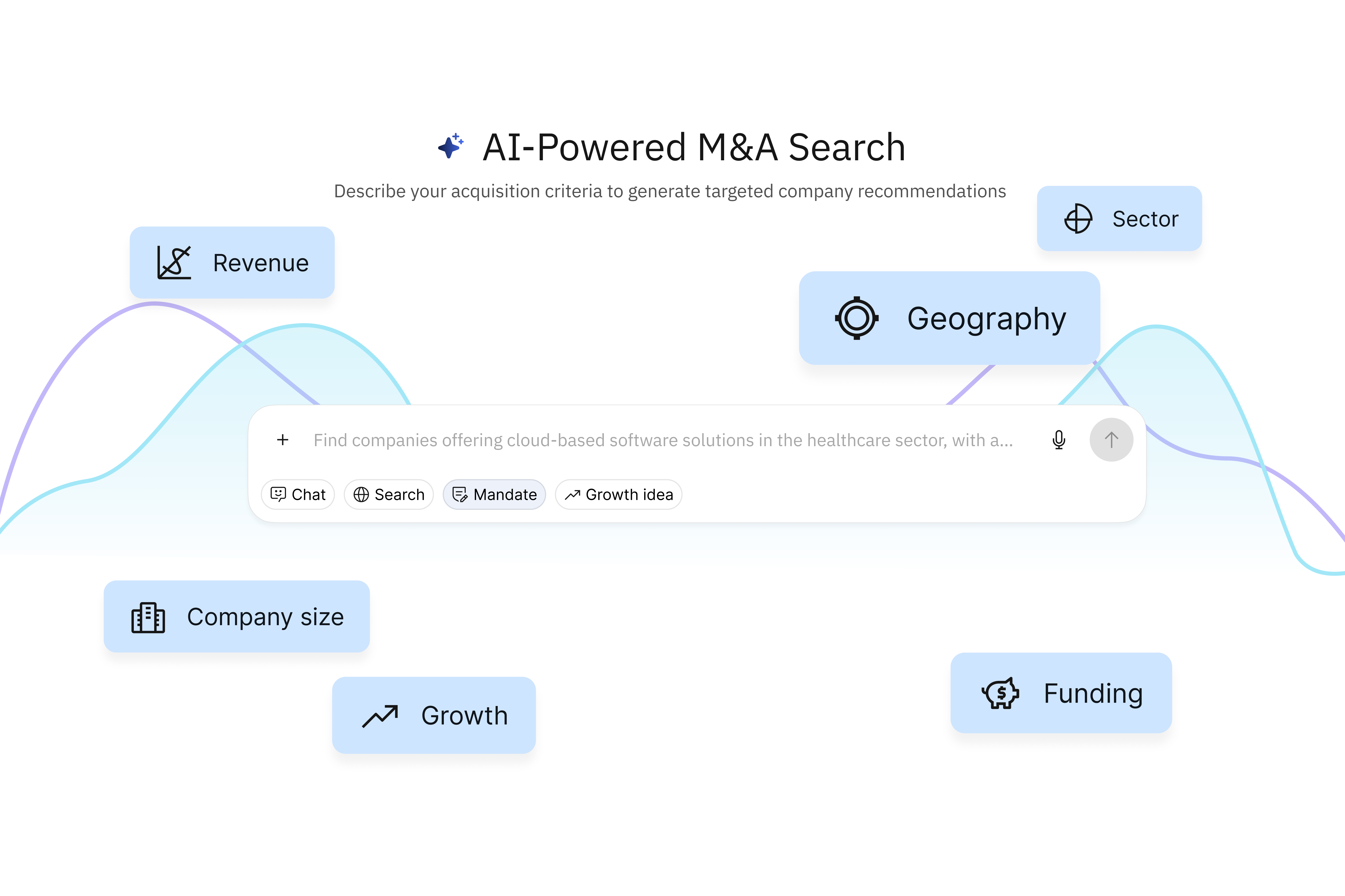

GrowthPal delivers AI-powered M&A search.

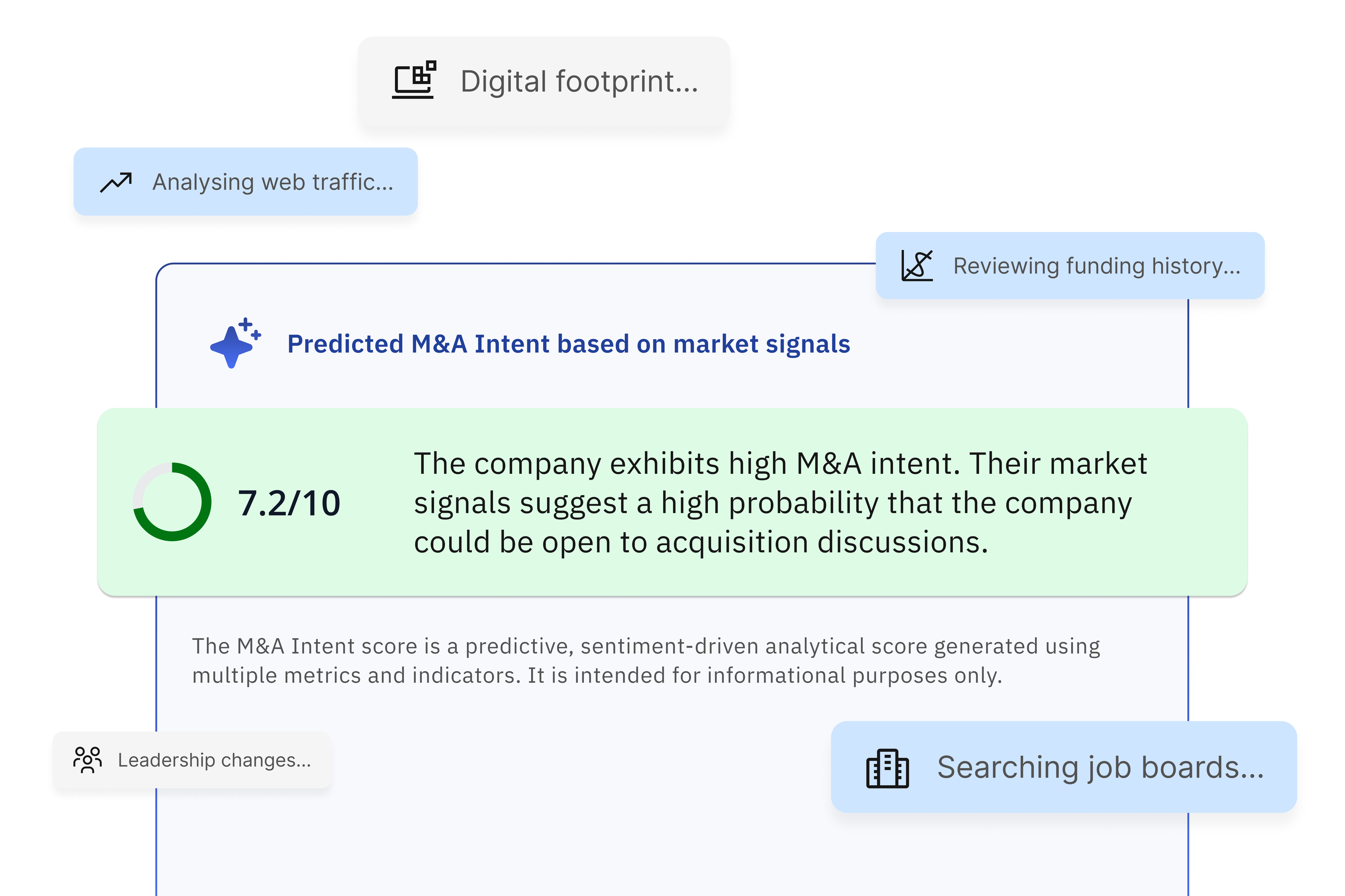

GrowthPal’s platform acts as an intelligent M&A copilot. When a buyer defines a growth objective - like acquiring a specific capability or entering a new geography - the system translates that goal into a structured acquisition thesis. Its AI agents then scan an enriched database of more than four million technology companies using signals from public filings, web activity, hiring trends, funding history, and other indicators. The result is a short list of precision-fit, often off-market targets that align closely with the buyer’s mandate, rather than broad lists of loosely relevant companies.

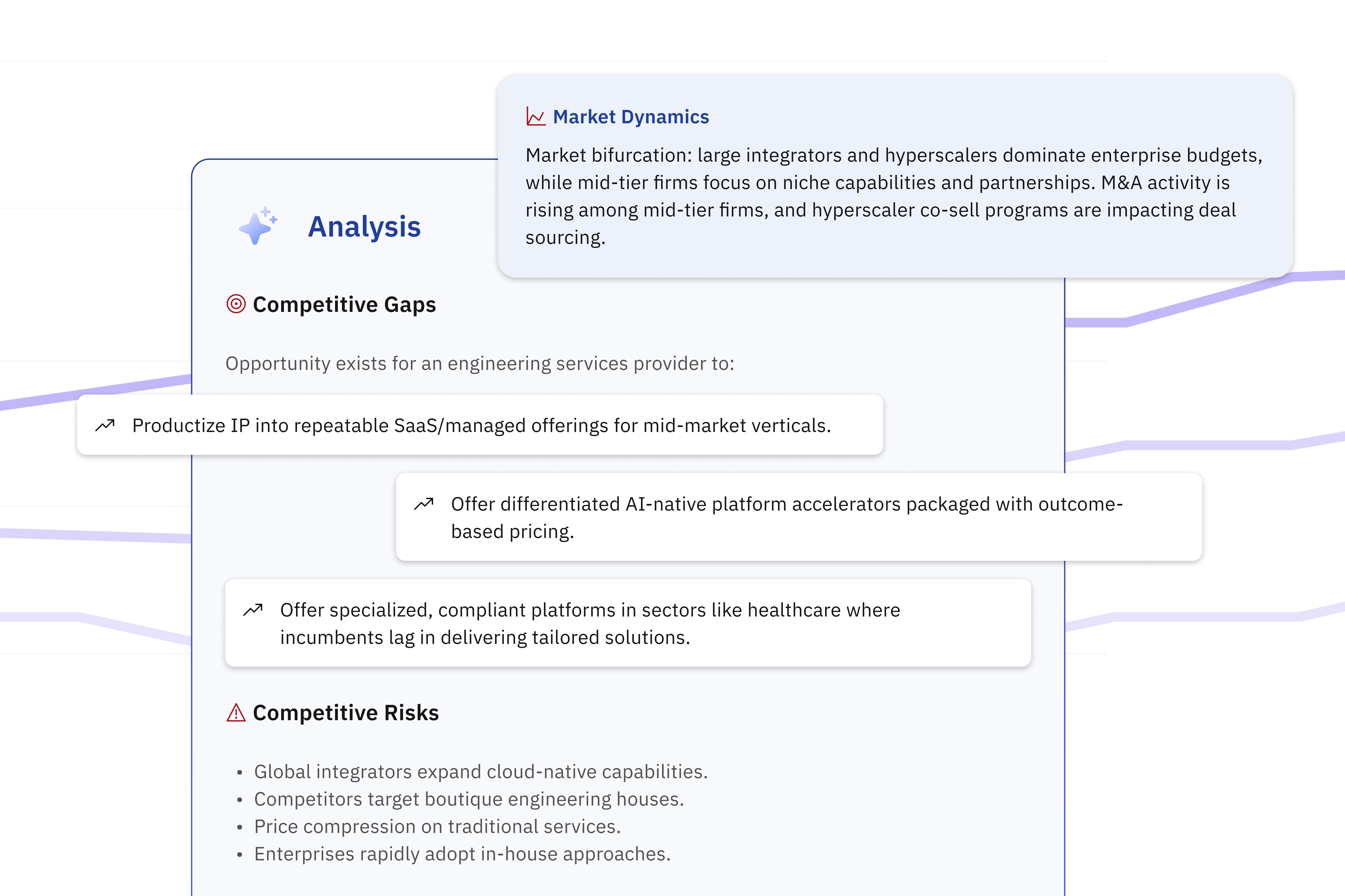

GrowthPal presents competitor analysis for users.

The company was founded to address a structural gap in the market. While more than a million meaningful startups exist globally, fewer than one percent scale successfully, often due to lack of timely exits or strategic partnerships. At the same time, many acquirers struggle to find the right targets efficiently, particularly for transactions under $70 million that fall below the focus of traditional investment banks. GrowthPal was created to connect these two sides by making deal sourcing proactive, discreet, and data-driven.

GrowthPal has already supported more than 42 completed M&A transactions and facilitated over 210 LOI-stage conversations across North America, Europe, Asia, and Latin America. Clients include large and mid-market enterprises, fast-growing startups, private equity-backed firms, and corporate development teams across sectors such as IT services, SaaS, fintech, and vertical software. In one case, a single client closed seven acquisitions within 18 months using the platform.

GrowthPal offers intent analysis insights.

The broader M&A landscape is increasingly shaped by data abundance and decision scarcity. Teams have more information than ever, yet struggle to turn it into conviction. As acquisitions become a core growth lever for companies of all sizes, the ability to reason across signals, context, and intent is becoming a competitive advantage.“GrowthPal is solving one of the most under-optimised parts of the M&A lifecycle,” said Naganand Doraswamy, Managing Partner at Ideaspring Capital. “By focusing on qualified deal discovery and using AI to compress timelines, the team is enabling a more systematic approach to inorganic growth that traditional tools cannot offer.”

Looking ahead, GrowthPal plans to extend its intelligence deeper into the transaction lifecycle, supporting valuation reasoning, deal structuring, and preparation for negotiations. The company’s long-term vision is to become the system of intelligence that helps teams make better M&A decisions earlier, with greater confidence and clarity, starting from discovery and extending through execution.

Media images can be found here.

About GrowthPal

GrowthPal’s AI-powered M&A copilot helps users identify off-market targets, validate fit, and accelerate deal execution turning strategy into action within days, not weeks.

Its data and intelligence-driven digital investment banking platform helps corporates acquire small to mid-sized targets globally to add to their revenues, markets, geographies, customers, products, and teams. We specialize in add-ons, tuck-ins, and bolt-ons and cover global markets including US, LATAM, UK, Europe, Asia, and specialize in Business Services and Software. The experienced team has helped 100+ clients and closed 40+ deals.

The platform combines data, machine learning algorithms, and human expertise to deliver the most relevant opportunities for any given mandate. The team uses sophisticated matching and scoring algorithms, then our in-house banking team reaches out, gauges interest, and facilitates introductions. For more information please visit https://www.growthpal.com/

For further information please contact the GrowthPal press office on press@growthpal.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.